Size isn't everything

Benefit size as proxy for socio-economic group

The traditional actuarial solution to addressing socio-economic differentials has been to use benefit size as a proxy for socio-economic group: the larger the pension or sum assured, the likelier the policyholder is to belong to a higher socio-economic group. The benefit size is known at the time a policy is set up, making it both reliable and convenient.

What's the problem?

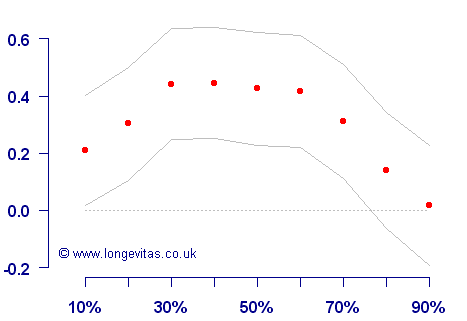

If benefit size were wholly indicative of socio-economic differentials, we would expect the highest excess mortality for the smallest policies, decreasing relatively smoothly as policy values increased. However, this is often not the case, as the example below shows for annuity business:

As we can see above, it is broadly true that mortality decreases by pension size from the mid-sized policies upwards. However, mortality appears to actually decrease for the lower third, which is counter-intuitive: surely these should be the poorest policyholders with the highest mortality? As it happens, pension size here is not a wholly reliable proxy for socio-economic group for a number of reasons:

- Wealthy people often have a number of pension policies, where the size of any one of them is not indicative of their overall income.

- Long-retired people tend to have smaller pensions than recently retired ones, thus conflating birth cohort with pension size.

- Surviving spouses often have pensions of half or two-thirds of the main pension, thus making pension size an indirect proxy for marital status.

The end result is that pension size is not the smooth, monotonic indicator of mortality by socio-economic group one would ideally like, as demonstrated above.

Improving on benefit size

We can see above that benefit size contains a lot of useful information, especially for larger policies. But how can we combat the weakness of pension size for the lower half of the business? A simple, easy and cheap way is to use the policyholder's address or postcode. Longevitas has built-in capabilities for automatically profiling policyholder postcodes for use in analysing mortality and other risks. Longevitas's flexible and open modelling approach allows you to include both benefit size and postcode-driven lifestyle as risk factors, along with many others. Using this combined approach, you can get far more accurate assessment of the socio-economic profile of a policyholder.

Lifestyle factors such as nutrition, obesity, smoking and fitness play a role in a large number of insurable risks...So can knowledge of lifestyle factors augment and overcome the weaknesses in pension size, and if so, how?