Johannes Karup

As discussed in earlier blogs, trailblazing actuaries Benjamin Gompertz and William Makeham used parametric models for the mortality hazard. However, the data they worked with were typically grouped into wide age ranges, which involves a loss of information if mortality rates are continually increasing.

An interesting stage in actuarial survival modelling was a publication in 1893 by the Danish actuary Johannes Karup. Working in Germany for a sickness-and-retirement fund for (presumably male) civil servants, he applied the Makeham survival model to the fund's own experience data at individual ages. This work represented a triple step forward:

Using the fund's own data avoided the basis risk inherent in using a table created elsewhere.

Using a smaller age interval of one year preserved more of the available information, and

Using knowledge of in-force lives, new entrants, deaths and non-death exits, Karup developed estimates of the exposure times for a mortality model in the presence of competing risks.

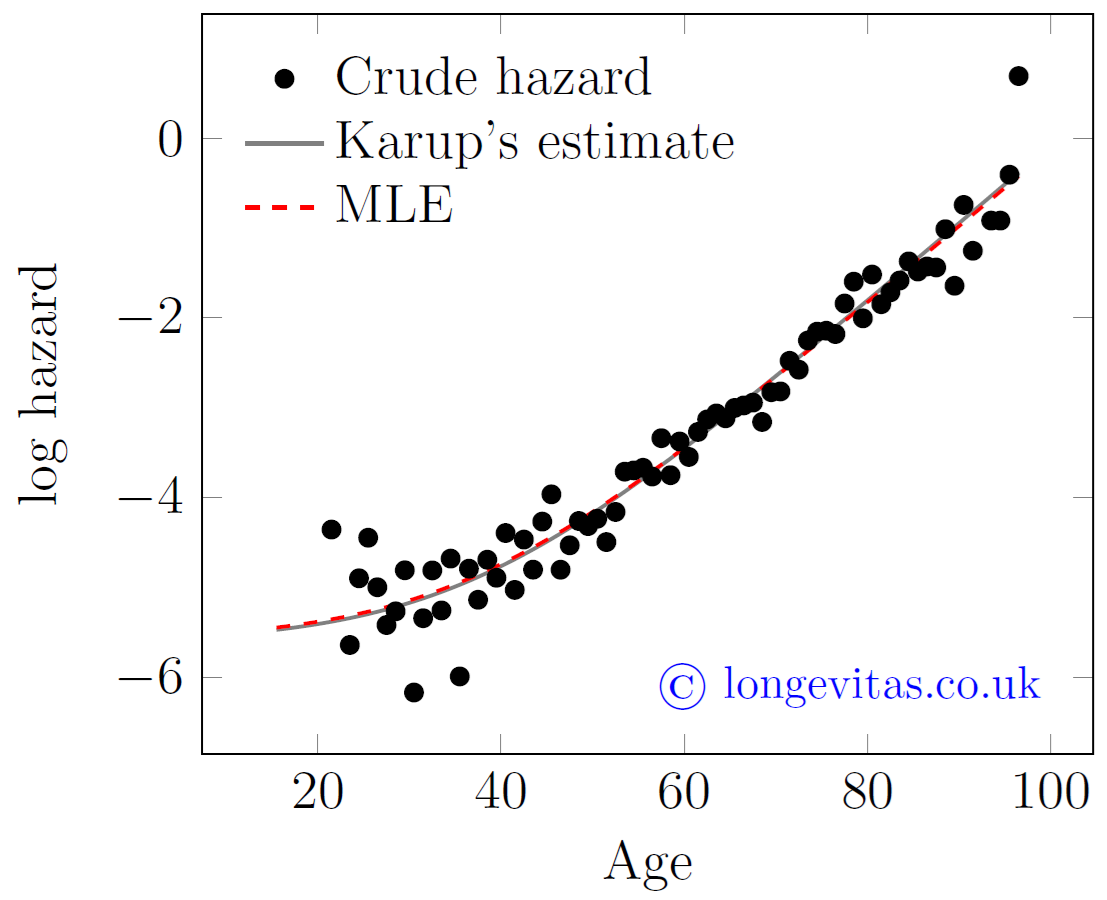

Karup (1893) fitted a Makeham model for the mortality hazard of the members of this society using the method documented in King (1887). Figure 1 shows the crude mortality hazard of the members, along with Karup's estimated hazard and the hazard using the modern method of maximising a likelihood function.

Figure 1. Plot of hazard rates for mortality-experience data in Karup (1893), together with the fitted Makeham hazards using (a) Karup’s approach and (b) maximum likelihood.

Figure 1 shows how good actuarial methods of fitting survival models were in the late 19th century. Even without electronic computers and the advantage of modern statistical knowledge, the two estimated hazards are never more than 4.2% different across the age range and are barely distinguishable in the plot.

More details on Karup's work, including the data he used, can be found in Richards (2026). The data can be downloaded using the link to the right of this blog.

References:

Karup, J. (1893) Die Finanzlage der Gothaischen Staatsdiener-Witwen-Societät am 31. Dezember 1890, Herzogliches Sächsisches Staatsministerium, Dresden.

King, G. (1887) Life Contingencies: Institute of Actuaries Textbook of the Principles of Interest, Life Annuities and Assurances, and Their Practical Application. Part 2. Charles & Edwin Layton, first edition.

Richards, S. J. (2026) The actuarial origins of survival models, Longevitas working paper.

Thanks to David Raymont and Ken Bogle at the Institute and Faculty of Actuaries for arranging the loan of Karup (1893).

Grouped-counts modelling in Longevitas

Longevitas is best known for the survival modelling of individual lifetimes, but it also supports grouped-counts modelling.

Previous posts

Dealing with dates in actuarial mortality investigations

When we first wrote our survival-modelling software in late 2005, we had to decide how to represent dates for the purpose of calculating exposure times. We decided to adopt a real-valued approach, e.g. 14th March 1968 would be represented as 1968.177596 (the fractional part is \(\frac{31+29+14}{366}\), since 1968 is a leap year).

Wilhelm Lazarus: A century ahead of his time

If this and other recent blogs have a historical flavour, the reason is the 200th anniversary of the 1825 paper by Benjamin Gompertz that introduced his eponymous law of mortality. In the course of his own researches, Stephen drew to my attention a short letter published by Wilhelm Lazarus in Journal of the Institute of Actuaries in 1862. It is a remarkable document.

Add new comment