Leverage in the annuity business

The recent bankruptcy filing for Lehman Brothers follows hard on the heels of the forced takeover of Bear Stearns earlier this year. Debt played a role in the demise of both: as with many banks and other businesses, they used borrowed money to enhance shareholder returns, a phenomenon known as leverage. Leverage works well when profits are made: the shareholders reap all the rewards of the total deployed capital, both their own and the borrowed funds. Of course, leverage also increases the downside risk: since debt has to be repaid no matter what, shareholder funds are first in line to be wiped out if things don't go according to plan.

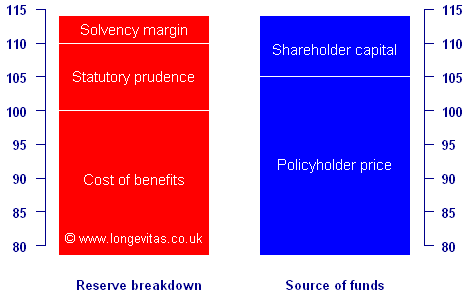

The use of borrowed money is not restricted to banks and corporate borrowers. Indeed, leverage is fundamental to the annuity business, as the chart below shows:

On the left we have the capital requirements for an annuity policy. It is made up of the estimated cost of the benefits (set at 100%) plus a margin for prudence due to insurance-company regulations, plus a further solvency margin. These funds have to come from somewhere, and this is shown on the right. The majority of the funds come from the policyholder in the form of the premium. The price paid is by definition greater than 100%, since the insurer expects a profit margin on top of the expected cost of benefits and expenses. The balance between what the policyholder pays and what the regulator requires has to be made up by shareholder capital.

The right-hand section shows where the leverage comes in. The shareholder capital has to make up the difference between two much larger numbers: the total reserve and the policyholder price. If anything should happen to raise the capital requirements on the left-hand side, then it is the shareholders who have to provide the extra funds. Capital requirements could rise due to an increase in the expected cost of the benefits, a strengthening of insurance-company reserving requirements, or an increase in the solvency margin. Whatever the cause, a 1% increase on the left-hand side will cause a 10-15% increase in shareholder capital.

Since annuity business is highly leveraged, shareholders demand a high rate of return on capital. It is also the reason why a great deal of effort is put into assessing socio-economic group. As the most important risk factor for longevity after age and gender, incorrectly assessing socio-economic group can wipe out an annuity's profit margin.

Add new comment