Sense and sensitivity

Annuities are a good example of the cornerstone of actuarial work: discounting future probabilities of payment to allow for the time value of money. Low interest rates have had major consequences for savers looking for income in retirement, but they are also one reason behind renewed actuarial focus on longevity in recent years.

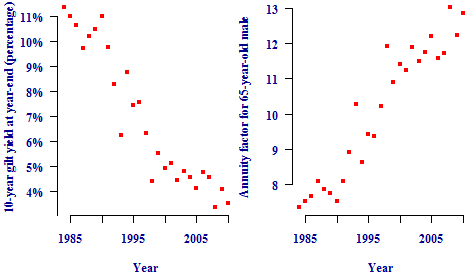

Simply put, actuaries' interest in mortality and longevity is inversely correlated with the yields obtained on gilts and corporate bonds. This is illustrated in Figure 1. The left panel shows how gilt yields have fallen since 1984, while the right panel shows how the cost of an annuity to a male aged 65 increases as the gilt yield falls. The right panel shows that the fall in yields would increase the cost of providing a level income by more than half (all other things being equal).

Figure 1. Gilt yields (left) and annuity factors for males aged 65 (right). Source: Own calculations using S1PA and end-year yields from British Government Stock (10-year nominal par yield, series IUAMNPY from the Bank of England).

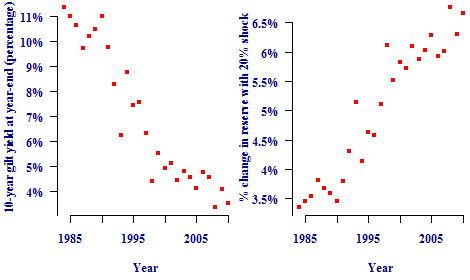

However, Figure 1 simply shows that annuity factors go up as yields go down. A less appreciated aspect of low interest rates is the increased sensitivity of annuity factors (and annuity reserves) to unexpected changes in mortality, a key item of interest for regulators and others. Figure 2 shows how the percentage change in reserves due to an immediate 20% reduction in mortality levels is also dependent on the discount rate.

Figure 2. Gilt yields (left) and change in annuity factor after 20% mortality shock (right). Source: Own calculations using S1PA and end-year yields from British Government Stock (10-year nominal par yield, series IUAMNPY from the Bank of England).

The choice of a 20% drop in mortality rates comes from the QIS5 rule for reserving for annuities under Solvency II. Figure 2 shows one reason why actuaries and regulators are a lot more focused on longevity risk nowadays: as interest rates have fallen, the sensitivity of annuity reserves and profitability to a longevity shock has nearly doubled (all other things being equal). Managing an annuity business has not got any easier since the 1980s.

One interesting side question raised by Figure 2 is whether annuities are expensive enough? At lower discount rates, the profitability of an insurer's annuity portfolio is a lot more exposed to longevity risk. Is a pricing margin of around 5% enough reward for the risks being taken?

Comments

Timely comment - longevity and interest rate down can be superadditive, and CEIOPS refers to these in discussions of superadditivity in their advice on tests and standards for internal model approval (see 5.234 of https://eiopa.europa.eu/fileadmin/tx_dam/files/consultations/consultati…). I see the longevity shock is the equivalent of a series of zero coupons arising after baseline life expectancy which can be 20+ years in duration.

Add new comment