Size isn't everything

In an earlier post we discussed the correct way of using postcodes for analysing mortality, and also how this works in countries outside the UK. It is worth re-iterating why insurers use so-called geodemographic profiling.

The first point is that the more risk factors in your underwriting model, the less likely an insurer will be selected against in the market. For example, if you price annuities just using age, gender and fund size while everyone else uses the same three plus postcode, you will lose money due to the relative lack of sophistication of your underwriting model. The richer your underwriting model, the less scope there is for being selected against by the rest of the market. Indeed, if your underwriting model is richer than everyone else's, it will be you who is making the money at the expense of the others.

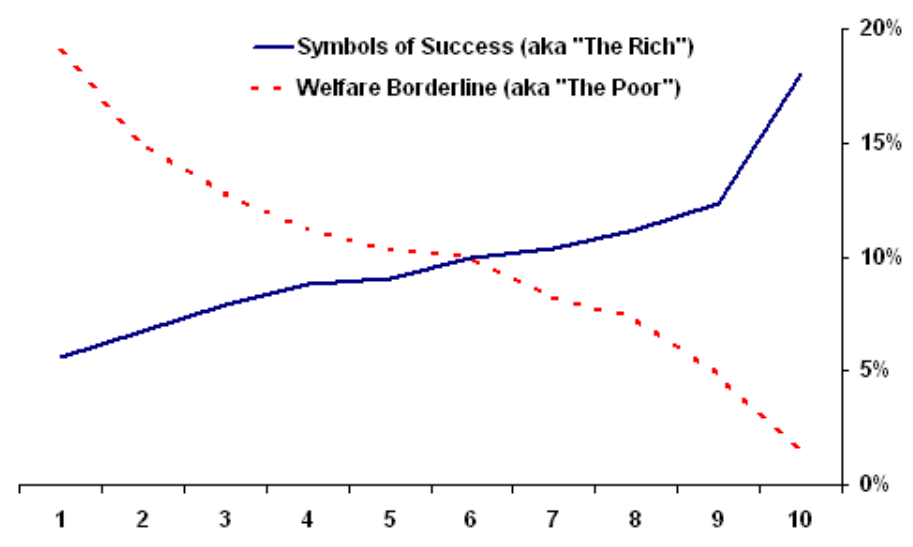

The second point is a specific example of the first. It involves correctly working out a person's socio-economic status, since this is linked to longevity and therefore the cost of an annuity. Actuaries traditionally used fund size as proxy for socio-economic group, but this is of mixed effectiveness. For example, when the fund size is very large, you can be fairly sure that the policyholder is of a high socio-economic status. However, the converse isn't quite so reliable: when the fund size is lower, it could be someone of low socio-economic status, or else it could just be a wealthy person phasing their retirement. This is evident in the chart below, which shows the proportion of each of two geodemographic groups falling into equal-sized pension bands:

The largest tenth of pensions are on the right-hand side. Sure enough, under 2% of the low-status group have pensions this large, while around 18% of the high-status group fall into this size band. Thus the very highest pension and fund sizes are indeed a useful predictor of high socio-economic status.

However, the clear relationship between pension size and socio-economic status breaks down when we look at small- and mid-sized pension bands. For example high- and low-status policyholders are equally likely to fall into the 6th decile around the middle. If you just use pension size as a rating factor, you are charging the same rate for both: over-charging the shorter-lived poor and under-charging the longer-lived rich. This might not be fair, but it is at least stable if every insurer is doing the same thing. However, if you are using postcodes, this is a business opportunity: you can win the business of the shorter-lived poor, while ensuring that the loss-making cases go to those insurers who don't use postcodes or addresses in their annuity underwriting.

Previous posts

Great Expectations

When fitting statistical models, a number of features are commonly assumed by users. Chief amongst these assumptions is that the expected number of events according to the model will equal the actual number in the data. This strikes most people as a thoroughly reasonable expectation. Reasonable, but often wrong.

Add new comment