Simulation and survival

In an earlier post we discussed how a survival model was directly equivalent to assuming future lifetime was a random variable. One consequence of this is that survival models make it quick and simple to simulate a policyholder's future lifetime for the purposes of ICAs and Solvency II.

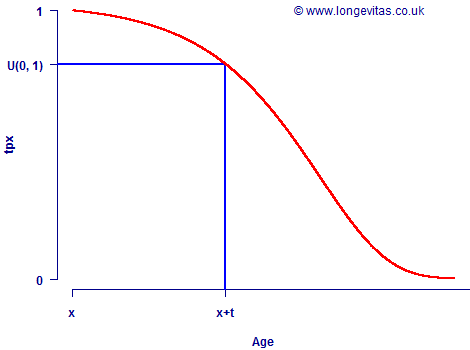

The survival curve is the proportion of lives surviving to each age, i.e. tpx in actuarial parlance. Below is a sample survival curve in red for a life aged x, showing how to read off the probability of survival to age x+t:

For simulation purposes we simply reverse this procedure: we generate a pseudo-random number uniformly distributed over the interval (0, 1), place it on the vertical axis and look up the age at death x+t.

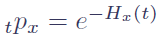

A huge advantage of survival models in simulation lies in the following simple formula for the survival probability:

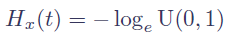

where Hx(t) is known as the integrated hazard function. For many survival models Hx(t) has a closed-form expression, and a list for the common actuarial laws of mortality is given in Richards (2008). The general formula above can then be re-arranged as follows for simulation purposes:

Depending on the choice of mortality law, this formula can be further manipulated to get a direct, closed-form expression for the simulated age at death, x+t. Using survival models can therefore give a quick and simple way of simulating the exact age at death from a single U(0,1) variate. This is particularly efficient when simulating an entire portfolio in run-off, life-by-life, since it means no model points need to be selected.

Add new comment