Can I interest you in a guaranteed loss-making investment?

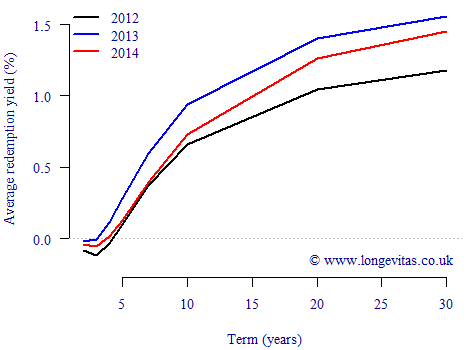

Would you buy an investment which was guaranteed to lose you money? This question was posed in a recent article in The Economist. The author of the article was referring to the fact that short-term interest rates were negative in Japan, Germany and Switzerland. This is not a recent anomaly either — Figure 1 shows that government bond yields in Switzerland have been below zero at short durations for several years now.

Figure 1. Yields by outstanding term for bonds issued by Swiss Confederation. Average annual yield curve 2012–2014. Source: SNB.

Negative yields at short durations are one thing, but the ten-year Swiss government bond yield went negative in mid-January 2015, and it is still negative at the time of writing. As the Economist article pointed out, it is hard to imagine many takers for a long-term asset which is guaranteed to make you a loss. But what if you already owned this sort of asset? This is the position that Swiss insurers and pension schemes will find themselves in, as they will have held such bonds to back their shorter-term liabilities. Since the value of a bond goes up when the yield goes down, they should be sitting on gains on those bonds they already hold.

While this sounds good, it might not be easy to realise those profits: what would they invest the money in instead? Superficially you might think they could just put the proceeds in the bank and earn no interest. However, large bank deposits now pay negative interest rates in some places: in Germany this goes by the vivid name of Strafzinsen, or "punishment interest". Strictly speaking this might actually be structured as a zero interest rate and a charge for holding the money, but the net effect is the same. The Swiss National Bank (SNB) introduced negative interest rates for large banks in December 2014, and those banks will have almost certainly passed these negative rates on to large depositors.

So, insurers and pension schemes in Switzerland should have profited on their existing holdings of government bonds, but it could be rather tricky to cash in those gains. A much bigger problem is the other side of insurers' and pension schemes' balance sheets: the very low and negative interest rates will have increased the value and sensitivity of their liabilities, thus neutralising those gains. Furthermore, capital held for stresses such as longevity risk will also increase.

These are challenging times for insurers and pension schemes, especially Swiss ones. However, where the Swiss lead others may have to (unwillingly) follow. Actuaries will need to pay close attention not only to the obvious investment considerations, but also the knock-on consequences for several non-investment risks like longevity.

References:

Buttonwood, "Accentuate the negative", The Economist, 24th January 2015.

Previous posts

Simulating the Future

This blog has two aims: first, to describe how we go about simulation in the Projections Toolkit; second, to emphasize the important role a model has in determining the width of the confidence interval of the forecast.

Add new comment